extended child tax credit 2022

That means eligible families will be able to claim the remaining 1800 in their tax returns. Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

The legislation made the existing 2000 credit per child more generous.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

. Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17. Ad Free means free and IRS e-file is included. You are single and your income is less than 75000.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. While not everyone took advantage of the payments which started in July 2021 and ended in. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

The maximum credit for taxpayers with no qualifying children is 1502. Ad Browse discover thousands of unique brands. Simple or complex always free.

The White House has also suggested that double-checks be sent out to make up for. Aline da Fonseca Child Tax Credit Outreach Coordinator. First its worth only 2000 per qualifying child.

Also employees not able to use all of their DCAP funds by the end of 2021 can still use the extended carryover or grace period into 2022. These payments were part of the American Rescue Plan a 19 trillion dollar. The future of the enhanced Child Tax Credit remains undecided.

See what makes us different. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments. Prior to 2021 the Child Tax Credit CTC was applied to annual tax returns.

Max refund is guaranteed and 100 accurate. DRS is partnering with the United Way and the Early Care and Education Center in Waterbury to participate in the BTs Sparkler Summer Series. Whether Biden can extend the enhanced CTC for 2022 depends on the voting outcome of a.

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. In 2017 this amount was increased to 2000 per child under 17. The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17.

For many families that meant six monthly payments of 300 or. Moreover in the second half of 2021 it became possible to. The most parents can receive from the tax credit is 8000 which applies to families with two or more children.

The expanded tax break lets families claim a credit worth 50 of their child care. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. Meanwhile 10 states are granting tax credits with the amount of the benefit and qualifying restrictions varying by state mostly based on the age of the children and household.

As such there was. Eligible families are those who meet the requirements. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return.

Child Tax Credit has now been reduced to a limit of 2000 per child causing many families to struggle to make ends meet. The American households should have gotten up to 1800 per child in Decembers payment. Thursday July 28 2022 600 pm.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. When the child tax credit came to an end in December roughly 37 million more children suffered from poverty according to a study by Columbia University. 1 day agoI was planning to write about the Child Tax Credit in light of the recently passed CHIPS Act which had bipartisan support.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. This credit does have a phase-out amount when you reach 400000 of adjusted gross income if you file married filing jointly or 200000. Coalition on Human Needs Alliance of national groups service providers faith groups policy experts and labor civil rights and other advocates Mission.

Last year the souped-up version delivered 3000 for children ages 6 and up and 3600 for younger children. If we can provide. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17.

They can apply for extended credit and receive more money when they file their taxes. However with the passage of ARPA half of the anticipated credit for 2021 was provided in the form of advance monthly payments. The latest research from Columbia shows.

For children under 6 the amount jumped to 3600. Read customer reviews best sellers. States Offering Child Tax Credits in 2022.

There are also special exceptions for people who are 18 years old and. We will have Child Tax Credit in 2022 to help working families with income covered by the program. That meant if a household claiming the credit owed the IRS no money it couldnt collect its.

Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for. On Thursday July 28 2022 DRS will be participating in a community event to raise awareness about the 2022 child tax rebate. Lawmakers increased the benefit from 2000 per child per year to a maximum of 3600 per child 5 or younger and 3000 for kids 6-17.

However there is high support for the direct payments to be extended into 2022. File a federal return to claim your child tax credit. The maximum child tax credit amount will decrease in 2022.

The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for spouses filing a joint return. Democrats roughly 2 trillion Build Back. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

We dont make judgments or prescribe specific policies. In the meantime the expanded child tax credit and advance monthly payments system have expired. In American plan of salvation was accepted into Congress in 2021 while increasing the amount eligible American families can receive from their Child tax credit payments.

Since July the federal government has sent the families of 61 million children monthly payments of 300 per child under 6 and 250 per older child.

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Parents Guide To The Child Tax Credit Nextadvisor With Time

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 Could You Get 750 From Your State Cnet

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Taxes 2022 What Families Should Know About The Child Tax Credit Youtube

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

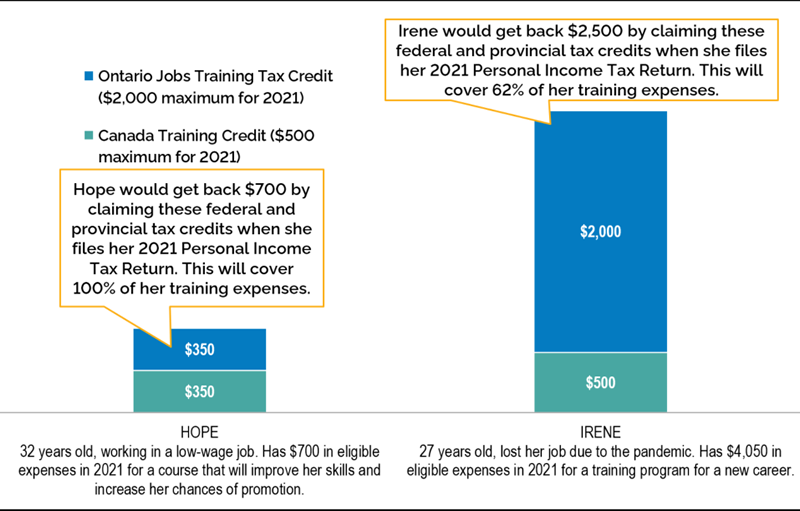

Ontario Jobs Training Tax Credit Ontario Ca

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit July 2022 Who Will Receive This Payment Child Credit Updates Youtube

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca